maine tax rates for retirees

Maine tax rates for retirees Friday August 12 2022 Edit Residents also pay income taxes at a rate of 65 on income between 5200 and 20899 and 795 on income of 20900. Although the state does not tax Social Security income expect high.

Property taxes are also above average in Maine.

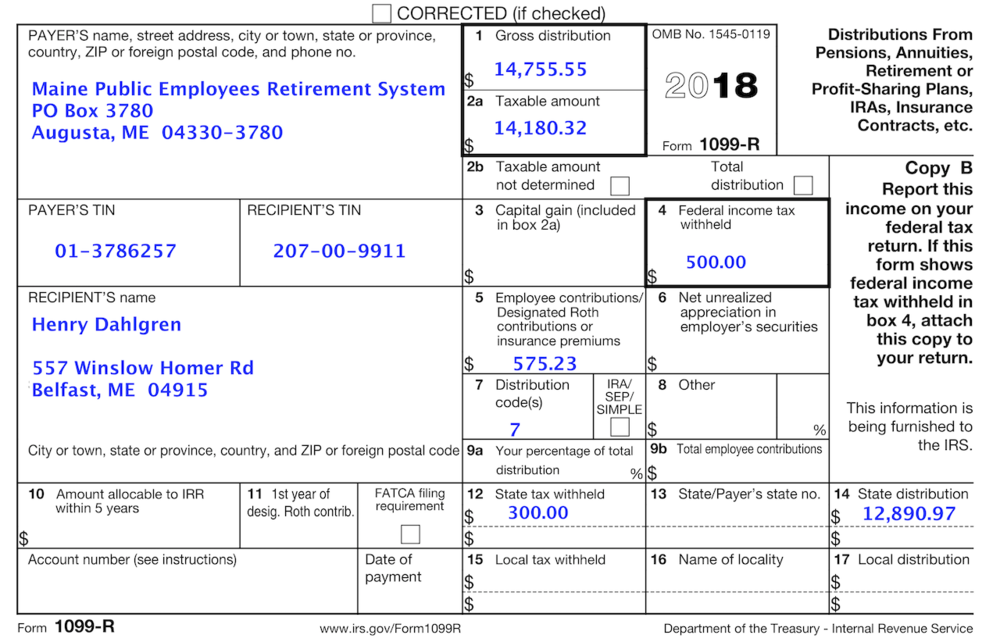

. However Maines sales tax rate is considerably low at 55. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. Maine personal income tax rates.

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Military retirement pay is exempt from taxes beginning Jan. While it does not tax social security income other forms of retirement income are taxed at rates as high as 715.

Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. MaineSTART offers both Traditional pre-tax and Roth after-tax accounts. If you are a public school interested in offering this benefit to your employees please contact Gary Emery at 207.

Prior to January 1 2013 the graduated rates ranged from 2 to 85. That would add up to taxes of 1200 on that. For state income taxes virginia doesnt tax social security.

Retiree paid Federal taxes on contributions made before January 1 1989. Maine authorized payments of 850 per person or. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

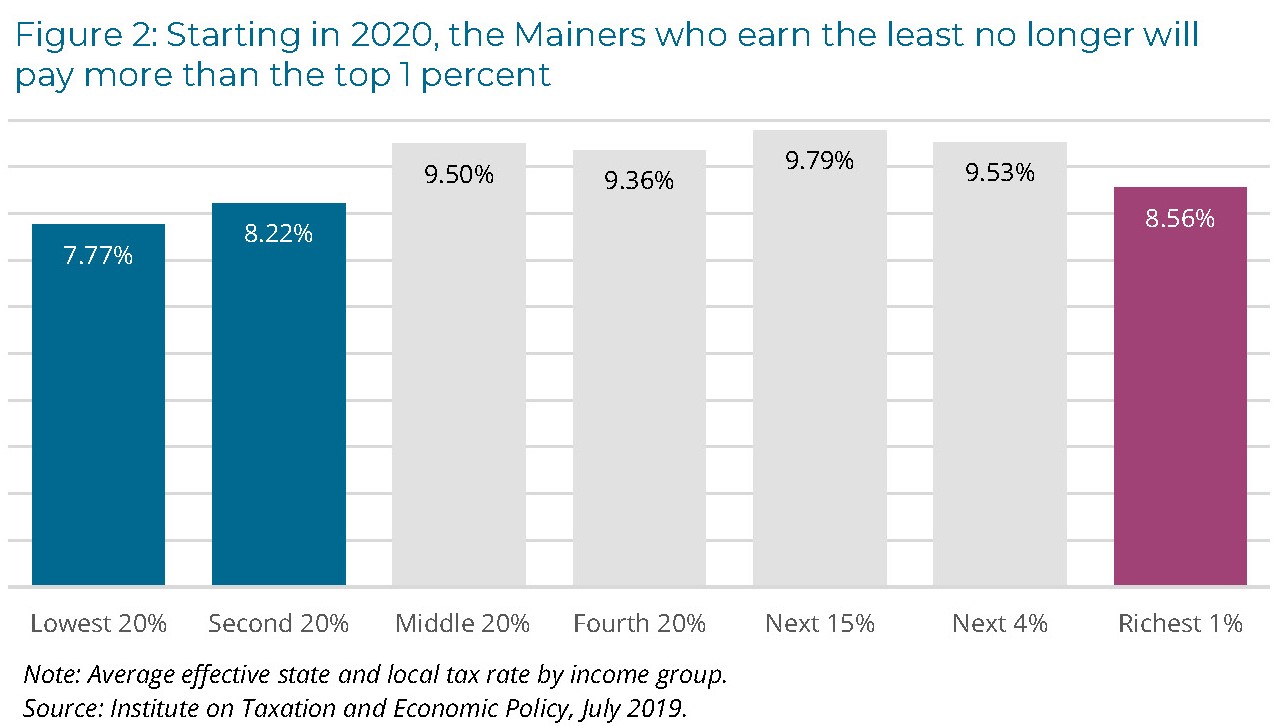

Maines income tax rate ranges from 58 to a top marginal rate of 715. However the states Franchise Tax Board expects 95 of payments to arrive in residents hands by Dec. Property taxes are also above average in Maine.

Single married filing separate. Maines income tax rate ranges from 58 to a top marginal rate of 715. Retiree has not paid Federal or State taxes on the interest their contributions earned while they were working.

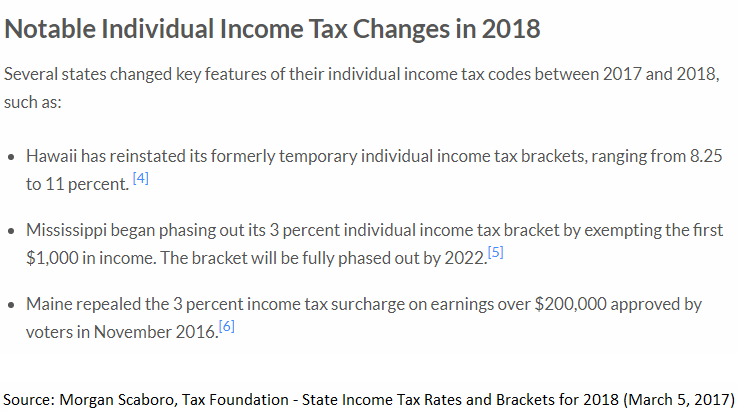

The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016.

State Tax Levels In The United States Wikipedia

Maine State Tax Guide Kiplinger

Tax Withholding For Pensions And Social Security Sensible Money

![]()

Video New Tax Credit Could Give Maine Workers A Big Boost Maine Beacon

Maine Reaches Tax Fairness Milestone Itep

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Maine Retirement Tax Friendliness Smartasset

Which States Have The Lowest Tax Rates Seniorliving Org

How Do State And Local Property Taxes Work Tax Policy Center

Budget Archives The Maine Wire

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

In This State Seniors Can Now Freeze Their Property Taxes Here S How Marketwatch

Maine State Taxes 2022 Income And Sales Tax Rates Bankrate

Tax Maps And Valuation Listings Maine Revenue Services

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Please Call Your Legislators Today And Urge Them To Oppose Bills To Increase Individual Or Corporate Income Tax Rates In Maine Maine State Chamber Of Commerce

These States Don T Tax Military Retirement Pay

Opinion Property Tax Stabilization Program Shifts Burden To State Taxpayers The Maine Wire